Seattle's Ground Up Construction Lender: Financing New Builds Across the Puget Sound

For experienced real estate investors and builders in Seattle, time is your most valuable asset. The Puget Sound market is severely constrained by geography and complex zoning, driving a critical need for infill development and new multi-unit supply. You need a financial partner who can move faster to navigate strict regulations and high costs. Archwest Capital provides agile, in-house ground up construction loans designed specifically for the unique demands of the Seattle investment landscape.

From new luxury custom homes in competitive areas like Madrona and Fremont to small-lot infill projects and multi-unit apartment construction in high-growth corridors like South Lake Union and the Eastside, our tailored financing and streamlined process empower you to build with confidence and speed.

Ground Up Construction Loan

Term

12 to 30 Months

Loan Amount

$250K to $5M+

LTC

Up to 85%

LTARV

Up to 67.5%

Property Types

Non-Owner Occupied

SFR, Condo, Townhome, 2–4 Plex

Multifamily Up to 9 Units

Infill, ADU, Community Builds

Power Your Next Build with Speed and Certainty

Ground up construction demands speed, flexibility, and reliable capital. Our Ground Up Construction Loan is built for experienced real estate investors ready to turn raw land or teardown sites into profitable residential developments. With competitive terms, strong leverage, and financing tailored to a wide range of property types, we deliver the certainty and resources you need to bring your vision to life.

From single-family homes and small multifamily projects to infill and portfolio builds, our Ground Up Construction Loan provides the capital structure and confidence to take your project from blueprint to completion, on time and on budget.

The Archwest Difference: A Lender Built for Builders

At Archwest Capital, we understand that your project’s success hinges on rapid, reliable financing. We are not a traditional bank; our lending approach is built on a deep understanding of investment real estate and the need for a lender who understands your business. Our loan programs are crafted for efficiency and flexibility, ensuring you have the capital you need precisely when you need it.

Pricing – We offer the most competitive terms in the industry.

Speed – We can close in as fast as 7 days, with 24 hour draws.

Expertise – Our construction lending team understands your needs.

Service – Smooth closings, easy draws, and future takeout solutions.

In-House Expertise & Dedicated Support Team

We make construction lending simple—from first call to final draw. Every loan decision at Archwest Capital is made by our in-house team of dedicated construction lending experts. We operate without a middleman, giving you direct access to underwriters and loan advisors who are intimately familiar with Seattle’s diverse housing stock. Our underwriting process is focused on the strength of the deal, the builder’s proven experience, and the completed value of the project not on personal income documentation. This streamlined approach allows us to deliver efficient turnarounds and record closing times, ensuring you can seize opportunities as soon as they arise.

Your Seattle Investment Partner: Local Market Insights

Beyond providing capital, Archwest Capital is a partner with unparalleled local market knowledge. Our team closely monitors the complex MHA (Mandatory Housing Affordability) zoning rules, high construction costs, and growth patterns unique to the entire Seattle MSA.

Specializing in Seattle's High-Demand Markets

We specialize in financing construction projects in the neighborhoods where Seattle’s experienced developers are finding the greatest success.

South Lake Union & Downtown: These core employment districts are highly competitive for vertical infill, mixed-use, and high-density apartment construction. Our agile process ensures you secure financing quickly to acquire prime parcels and maximize density for premium stabilization.

Ballard & Capitol Hill: These established urban neighborhoods are ideal for multi-unit townhome infill and small-scale apartment development leveraging increased density allowances. We have the expertise to fund contemporary designs that capitalize on location and meet strict neighborhood compatibility demands.

Eastside Corridors (Bellevue, Redmond): From high-density apartment developments near tech campuses to targeted infill construction in established high-demand suburbs, our financing solutions are tailored to the wide range of ground up opportunities where adding density is critical across the entire Puget Sound region.

Benefits in the Seattle Market

| Benefits | Why It Matters Here |

|---|---|

| Streamlined Approval | Get started fast and keep your build on track. |

| Flexible Leverage | Tailored LTC/LTV to maximize returns. |

| Market-Aligned Terms | Fixed and adjustable rates to match conditions. |

| Builder-Focused Underwriting | Experience and viability matter more than personal income. |

| Local Development Fit | Perfect for infill lots, SFRs, and small multifamily projects. |

What Our Partners Say

I’ve worked with Archwest Capital on both a bridge loan and a full construction loan, and their team, led by Danny, consistently goes above and beyond. As a developer in the valley, having a reliable lending partner is crucial—and Archwest delivers with outstanding service, accessibility, and a proactive mindset. Danny once took my call on a Saturday and had everything I needed in my inbox by Monday, showing his genuine commitment to clients. Most recently, they helped us close a complex deal with overseas owners, coordinating late-night calls, Zooms, and emails to get it done smoothly. Their dedication and flexibility have made a lasting impression.

Kevin H.

Developer

If getting a loan was an Olympic sport, Justin would take home the gold—while answering emails mid-victory lap. He’s the kind of lender who actually picks up the phone, responds faster than our morning coffee kicks in, and somehow makes the whole process dare I say enjoyable.

Need a lender who gets ish done? Justin’s your guy. Need one who keeps things smooth and stress-free? Still Justin. Need one who can time travel to close deals at warp speed? I’m pretty sure he’s working on that too.

Bottom line: If you’re looking for a lender who’s a pleasure to work with and makes financing feel effortless, call Justin. Just don’t ask him to slow down—he physically can’t.

Matt S.

Real Estate Investor

I’ve had the pleasure of working with Jennifer Lightbody & Jennifer Tran on numerous transactions and the experience was nothing short of exceptional. They are both incredibly professional, responsive and knowledgeable. They are always ahead of the game during the funding process, and always make sure the loan gets funded as smoothly as possible. They are both a DREAM to work with. I cant recommend them both enough!

Natalie N.

Real Estate Investor

I used Archwest to help fund a large transaction involving multiple new construction homes. It was not a typical project, but we were able to close on time.

I’d highly recommend collaborating with Archwest on any real estate projects.

Jonathan C.

Real Estate Investor

Archwest has the most efficient lending team I have ever worked with.

They work quickly and clearly to make sure their customers are fully satisfied, all while being friendly and approachable. They make what seems like the impossible, possible.

My team and I look forward to working with them on many more deals to come.

Emilienne F.

Real Estate Investor

Archwest is the best lender to the best builders. We help clients move fast, build smart, and maximize returns.

How It Works

Project Review & Builder Experience

We assess your plans and track record to ensure a strong market fit.

Budget & Valuation

Detailed review of budget, scope, and exit strategy with appraisals based on completed value.

Loan Structure & Underwriting

Interest-only payments during construction; underwriting focused on project strength.

Draw Process & Timeline

Funds released in milestone stages (foundation, framing, inspections) for smooth progress.

Completion & Exit

Refinance, sell, or hold—we help align your exit with your investment goals.

Frequently Asked Questions About

Ground Up Construction Loans in Seattle

What is a ground up construction loan?

A ground-up construction loan is a type of short-term financing used to fund the construction of a new property from scratch, including the purchase of the land, labor, and building materials. Unlike traditional mortgages, these loans are disbursed through a “draw” process as construction milestones are met.

What are the typical requirements for a ground up construction loan?

At Archwest Capital, we focus on the deal’s merit, not personal income. Our key requirements include a project plan, detailed budget, and a proven track record of builder experience. While a minimum credit score is often required, a lender’s focus is on the deal’s viability and your ability to execute.

How does the loan draw process work?

The loan draw process is the way funds are disbursed during construction. Once the loan closes, a series of scheduled draws are made to pay for completed work and materials. This process is managed by your dedicated account manager who, after a quick inspection to verify completion, will disburse funds into your construction account.

What is the typical loan term and interest rate?

Our ground-up construction loan terms range from 12 to 30 months with interest-only payments during construction. We offer competitive fixed and adjustable rates tailored to your project. Interest payments are only on the funds you have drawn, not the entire loan amount.

How do your loans differ from a traditional bank loan?

Traditional bank loans often require extensive personal income documentation, a low debt-to-income ratio, and a lengthy approval process. Archwest Capital focuses on the investment property itself and the builder’s experience, providing a faster, more flexible, and more efficient path to funding your business-purpose project.

Ready to Build in Seattle?

Start your next project with a lender who understands your business.

Nationwide Lender with Local Expertise

County: King, Snohomish, Pierce

City: Seattle, Bellevue, Tacoma, Everett, Redmond, Kent, Auburn, Bothell, Shoreline, Renton

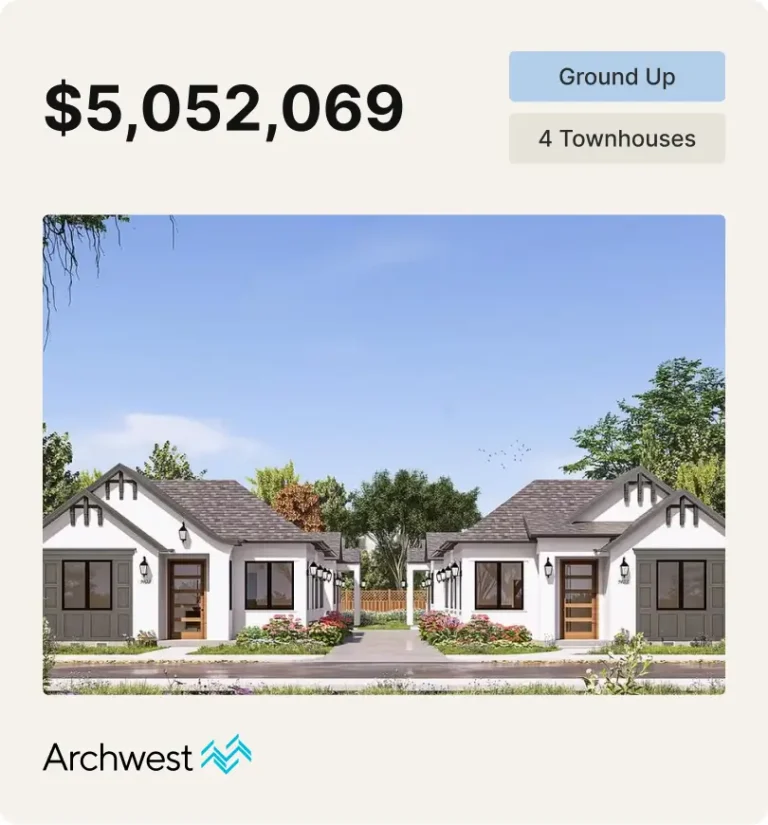

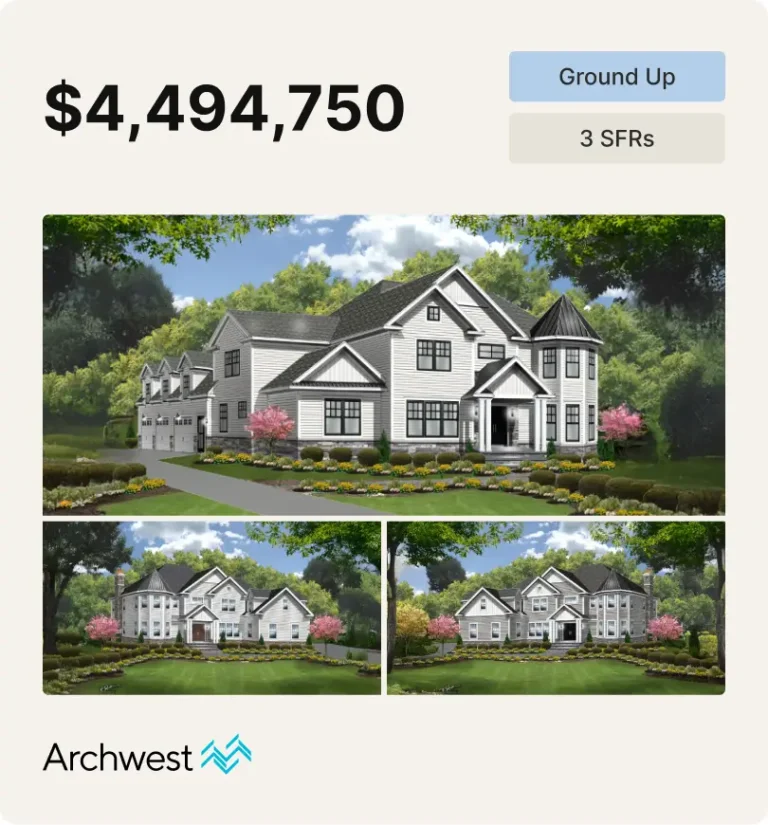

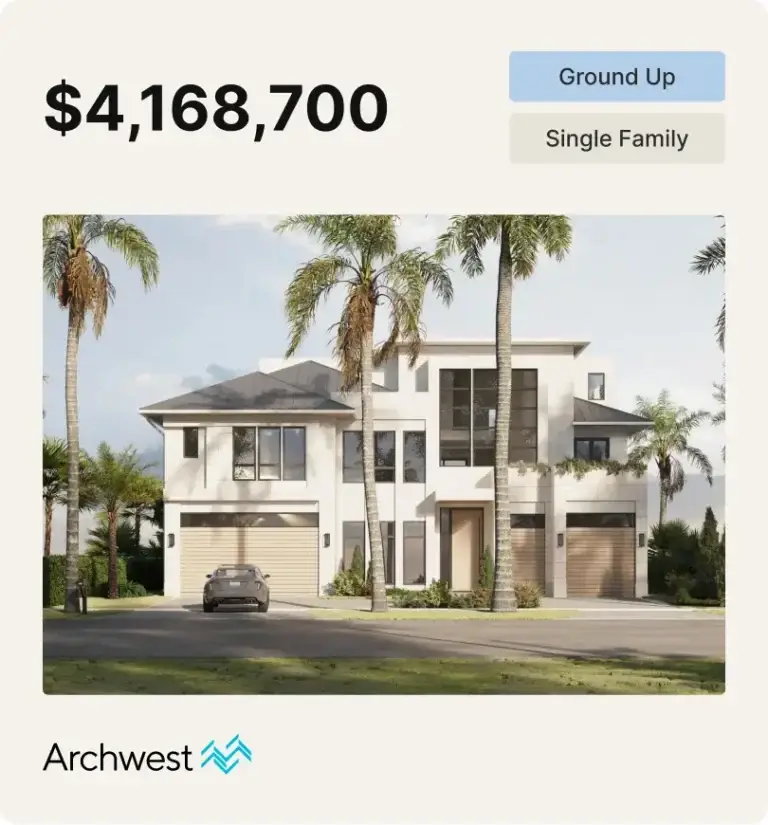

Recently Funded

Let's Build Together

From South Lake Union to Capitol Hill, Bellevue to Tacoma, the Seattle Metro offers abundant infill opportunities and significant project volume for experienced builders. Archwest gives you the capital and speed to make it happen.