According to several demographic statistics, including the U.S. Consensus Bureau, Phoenix is without a doubt one of the fastest growing cities in the United States. In fact, it is considered the fastest growing in the nation over the last five years. Arizona’s capital is now home to over 1.7 million residents. This growth fuels the demand for more residences and ultimately the multifamily market in The Valley of the Sun.

Archwest Capital gathers the latest multifamily real estate statistics in Phoenix each quarter covering the top stats for multifamily property cap rates, rentals, sales, and construction statistics.

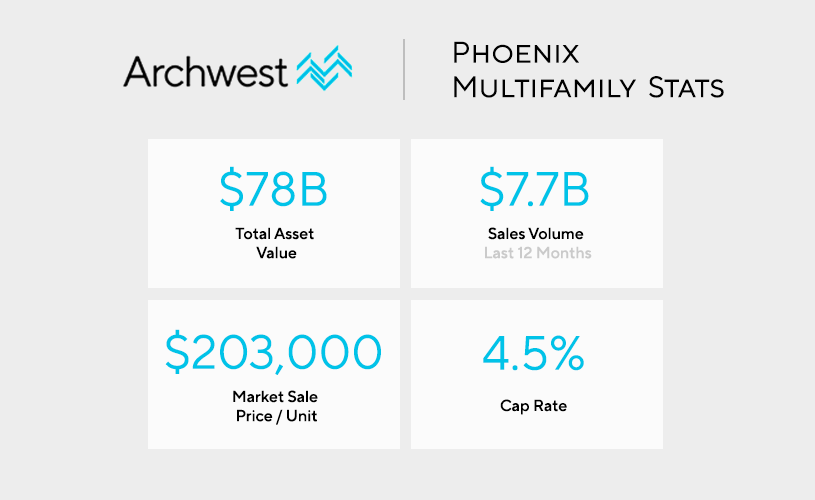

Within the Phoenix multifamily report, we also cover the capital market stats with the latest asset value, sales volume, cap rates, and real estate buyer / owner information.

Phoenix Multifamily Real Estate Market Stats

The total asset value of Phoenix’s multifamily real estate market is currently $78B. The sales volume during the last year nearly reached $10B at $9.9B total with an average sale price per unit of $203K. The cap rate of Phoenix multifamily real estate is currently 4.2%.

Total Asset Value: $78B

Sales Volume (Last 12 Months): $7.7B

Market Sale Price / Unit: $203,000

12 Month Market Sale Price / Unit: 21.2%

Cap Rate: 4.5%

Phoenix Multifamily Real Estate Sales Volume by Buyer Type & Origin (Past 12 Months)

Below are the respective buyer types and their origins vis-a-vis being a local, national, or international buyer of multifamily property in Phoenix.

Buyer Type:

Private: 57%

User: 1%

Institutional: 20%

Private Equity: 21%

REIT / Public: 1%

Buyer Origin:

Local: 9%

National: 84%

Foreign: 7%

Phoenix Multifamily Real Estate Asset Value by Owner Type & Origin (Past 12 Months)

Below are the respective owner types and their origins vis-a-vis being a local, national, or international owner of multifamily property in Phoenix.

Owner Type:

Private: 56%

User: 8%

REIT / Public: 6%

Institutional: 19%

Private Equity: 11%

Owner Origin:

Local: 21%

National: 74%

Foreign: 5%

Top Phoenix Multifamily Real Estate Property Statistics

The total amount of multifamily unit deliveries over the past 12 months in Phoenix is 9,025 with a net absorption of 14,925 units. The average vacancy rate of all multifamily properties in the area is 5.0% with a 12 month rent growth of 17.0%.

12 Month Deliveries (Units): 9,025

12 Month Net Absorption (Units): 14,925

Vacancy Rate: 5.0%

12 Month Rent Growth: 17.0%

Key Indicators for Multifamily Properties in Phoenix Based on Rating

4 & 5 Star

Units: 146,768

Vacancy Rate: 6.5%

Asking Rent: $1,663

Absorption Units: 2,349

Delivered Units: 2,616

Under Construction Units: 17,765

3 Star

Units: 132,391

Vacancy Rate: 3.6%

Asking Rent: $1,248

Absorption Units: 929

Delivered Units: 0

Under Construction Units: 2,733

1 & 2 Star

Units: 58,191

Vacancy Rate: 4.4%

Asking Rent: $935

Absorption Units: 239

Delivered Units: 0

Under Construction Units: 0

Phoenix Multifamily Sales Statistics (Past 12 Months)

Phoenix had 477 total multifamily properties exchange hands over the last year. The average price for the properties was $20.8M with an average sale of $203K / unit. The average vacancy of the multifamily properties sold was 5.8% at the time of sale.

Sales Comparables: 477

Average Price / Unit: $203,000

Average Price of Multifamily Property: $20,800,000

Average Vacancy at Sale: 5.8%

Top Phoenix Multifamily Property Sales (Past 12 Months)

The Top 5 Multifamily Transactions in Phoenix are listed below. They are ranked by the total dollar amount involved in the transaction.

1) *Rating: 4

Year Built: 1996

Units: 832

Vacancy: 2.4%

Price (Unit): $178,500,000 ($214,543)

Price / SF: $247

2) *Rating: 4

Year Built: 2008

Units: 523

Vacancy: 8.8%

Price (Unit): $146,000,000 ($279,158)

Price / SF: $243

3) *Rating: 4

Year Built: 1999

Units: 576

Vacancy: 2.6%

Price (Units): $145,250,000 ($252,170)

Price / SF: $285

4) *Rating: 4

Year Built: 1997

Units: 480

Vacancy: 3.8%

Price (Unit): $131,000,000 ($272,916)

Price / SF: $281

5) *Rating: 5

Year Built: 2014

Units: 389

Vacancy: 1.5%

Price (Units): $129,250,000 ($332,262)

Price / SF: $323

*Rating is 1-5, 5 being the best

Phoenix Multifamily Construction Projects Stats

Phoenix currently has 77 active multifamily properties under construction bringing an aggregate of 20,447 new units to the area. This represents 6.1% of the current multifamily inventory in Arizona’s capital.

Properties Currently Under Construction: 77

Total Amount of Multifamily Units: 20,447

Percent of Inventory: 6.1%

Average # of Units: 266

Top Phoenix Multifamily Projects Under Construction

The Top 5 Multifamily Projects Under Construction in Phoenix are listed below. They are ranked by the amount of units added to the total multifamily real estate inventory.

1) Rating*: 3

Units: 736

Stories: 4

Project Completion: Q4 2022

2) Rating*: 4

Units: 651

Stories: 4

Project Completion: Q2 2023

3) Rating*: 4

Units: 651

Stories: 4

Project Completion: Q2 2023

4) Rating*: 5

Units: 586

Stories: 24

Project Completion: Q4 2021

5) Rating*: 4

Units: 552

Stories: 3

Project Completion: Q3 2022

*Rating is 1-5, 5 being the best

Data Sources: Archwest Capital & CoStar

Phoenix, AZ Multifamily Loan Products

Archwest Capital’s commercial real estate experts provide multifamily market insights in Phoenix with the statistics above, and also have access to various financing options. Learn more about Archwest Capital’s Arizona Multifamily Loan Products here. Our team is happy to help with any questions you may have regarding potential multifamily investments in Arizona.