Nashville multifamily real estate is consistently supported by healthy population growth in the area. According to World Population Review, the population in Nashville has grown steadily between 1.4% and 2.0% year-over-year during the last decade. It also has been touted as one of the top markets for job growth in the country during the last decade. These factors provide a solid foundation for the multifamily market and multifamily real estate investors alike.

Archwest Capital gathers the latest multifamily real estate statistics in Nashville each quarter covering the top stats for multifamily property cap rates, rentals, sales, and construction statistics.

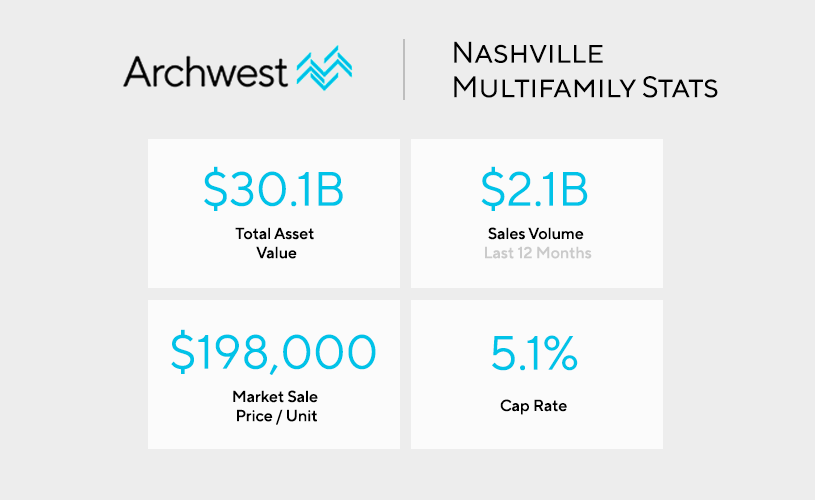

Within the Nashville multifamily report, we also cover the capital market stats with the latest asset value, sales volume, cap rates, and real estate buyer / owner information.

Nashville Multifamily Real Estate Market Stats

The total asset value of Nashville’s multifamily real estate market is currently $30.1B. The sales volume during the last year was a bit over $2B at $2.1B total with an average sale price per unit of $198K. The cap rate of Nashville multifamily real estate is currently 5.1%.

Total Asset Value: $30.1B

Sales Volume (Last 12 Months): $2.1B

Market Sale Price / Unit: $198,000

12 Month Market Sale Price / Unit: 8.5%

Cap Rate: 5.1%

Nashville Multifamily Real Estate Sales Volume by Buyer Type & Origin (Past 12 Months)

Below are the respective buyer types and their origins vis-a-vis being a local, national, or international buyer of multifamily property in Nashville.

Buyer Type:

Private: 58%

User: <1%

Institutional: 15%

Private Equity: 14%

REIT / Public: 12%

Buyer Origin:

Local: 5%

National: 95%

Foreign: 0%

Nashville Multifamily Real Estate Asset Value by Owner Type & Origin (Past 12 Months)

Below are the respective owner types and their origins vis-a-vis being a local, national, or international owner of multifamily property in Nashville.

Owner Type:

Private: 53%

User: 9%

REIT / Public: 16%

Institutional: 17%

Private Equity: 5%

Owner Origin:

Local: 33%

National: 63%

Foreign: 4%

Top Nashville Multifamily Real Estate Property Statistics

The total amount of multifamily unit deliveries over the past 12 months in Nashville is 5,272 with a net absorption of 7,926 units. The average vacancy rate of all multifamily properties in the area is 6.6% with a 12 month rent growth of 10.1%.

12 Month Deliveries (Units): 5,272

12 Month Net Absorption (Units): 7,926

Vacancy Rate: 6.6%

12 Month Rent Growth: 10.1%

Key Indicators for Multifamily Properties in Nashville Based on Rating

4 & 5 Star

Units: 60,556

Vacancy Rate: 7.9%

Asking Rent: $1,704

Absorption Units: 207

Delivered Units: 0

Under Construction Units: 7,672

3 Star

Units: 49,090

Vacancy Rate: 6.0%

Asking Rent: $1,249

Absorption Units: 113

Delivered Units: 0

Under Construction Units: 5,900

1 & 2 Star

Units: 26,344

Vacancy Rate: 4.7%

Asking Rent: $1,054

Absorption Units: -2

Delivered Units: 0

Under Construction Units: 0

Nashville Multifamily Sales Statistics (Past 12 Months)

Nashville had 71 total multifamily properties exchange hands over the last year. The average price for the properties was $31.7M with an average sale of $198K / unit. The average vacancy of the multifamily properties sold was 10.0% at the time of sale.

Sales Comparables: 71

Average Price / Unit: $198,000

Average Price of Multifamily Property: $31,700,000

Average Vacancy at Sale: 10.0%

Top Nashville Multifamily Property Sales (Past 12 Months)

The Top 5 Multifamily Transactions in Nashville are listed below. They are ranked by the total dollar amount involved in the transaction.

1) *Rating: 5

Year Built: 2016

Units: 431

Vacancy: 1.6%

Price (Unit): $157,943,500 ($366,458)

Price / SF: $217

2) *Rating: 4

Year Built: 2015

Units: 393

Vacancy: 4.3%

Price (Unit): $130,351,037 ($331,682)

Price / SF: $202

3) *Rating: 4

Year Built: 1997

Units: 598

Vacancy: 6.4%

Price (Units): $127,000,000 ($212,374)

Price / SF: $187

4) *Rating: 4

Year Built: 2020

Units: 342

Vacancy: 52.6%

Price (Unit): $105,000,000 ($307,017)

Price / SF: $398

5) *Rating: 3

Year Built: 1987

Units: 468

Vacancy: 3.9%

Price (Units): $100,000,000 ($213,675)

Price / SF: $268

*Rating is 1-5, 5 being the best

Nashville Multifamily Construction Projects Stats

Nashville currently has 57 active multifamily properties under construction bringing an aggregate of 13,572 new units to the area. This represents 10.0% of the current multifamily inventory in Tennessee’s capital.

Properties Currently Under Construction: 57

Total Amount of Multifamily Units: 13,572

Percent of Inventory: 10.0%

Average # of Units: 238

Top Nashville Multifamily Projects Under Construction

The Top 5 Multifamily Projects Under Construction in Nashville are listed below. They are ranked by the amount of units added to the total multifamily real estate inventory.

1) Rating*: 4

Units: 400

Stories: 5

Project Completion: Q1 2023

2) Rating*: 3

Units: 398

Stories: 5

Project Completion: Q2 2022

3) Rating*: 4

Units: 384

Stories: 4

Project Completion: Q4 2022

4) Rating*: 4

Units: 380

Stories: 20

Project Completion: Q2 2023

5) Rating*: 4

Units: 364

Stories: 4

Project Completion: Q3 2021

*Rating is 1-5, 5 being the best

Data Sources: Archwest Capital & CoStar

Nashville, TN Multifamily Loan Products

Archwest Capital’s commercial real estate experts provide multifamily market insights in Nashville with the statistics above, and also have access to various financing options. Learn more about Archwest Capital’s Tennessee Multifamily Loan Products here. Our team is happy to help with any questions you may have regarding potential multifamily investments in Tennessee.