The Mile High City has been a top city in the United States as far as population growth goes in recent years. In fact, the Denver-Lakewood-Aurora MSA is ranked in the Top 15 for fastest growing metropolitan areas in the last decade. This consistent flow of new residents to the area has fueled many sectors of the local economy, particularly the Denver multifamily real estate market.

Archwest Capital gathers the latest multifamily real estate statistics in Denver each quarter covering the top stats for multifamily property cap rates, rentals, sales, and construction statistics.

Within the Denver multifamily real estate report, we also cover these crucial capital market stats with the latest asset value, sales volume, cap rates, and real estate buyer / owner information.

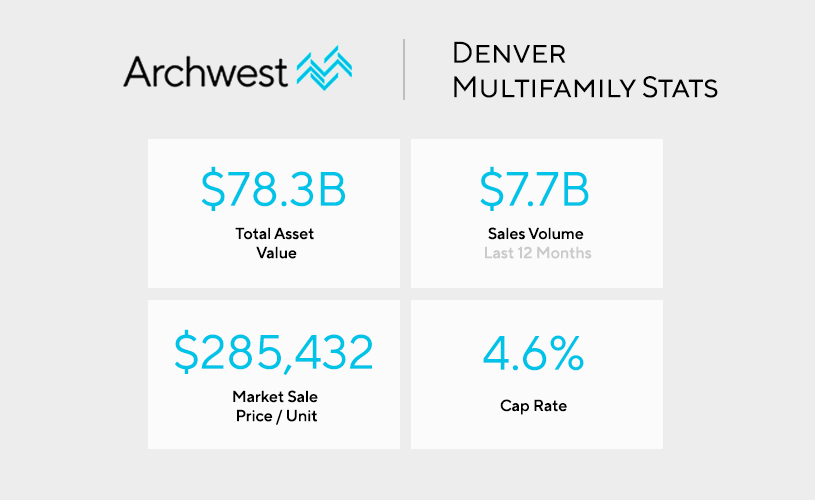

Denver Multifamily Capital Market Stats

The total asset value of Denver’s multifamily real estate market currently stands at nearly $78.3B. The sales volume during the last year was a bit over $5B at $5.026B total with an average sale price per unit of $285K. The cap rate of Denver multifamily real estate is currently 4.6%.

Total Asset Value: $78.3B

Sales Volume (Last 12 Months): $7.7B

Market Sale Price / Unit: $285,432

12 Month Market Sale Price / Unit Change: 10.4%

Cap Rate: 4.6%

Denver Multifamily Real Estate Sales Volume by Buyer Type & Origin (Past 12 Months)

Buyer Type:

Private: 49%

User: 4%

Institutional: 21%

Private Equity: 22%

REIT / Public: 4%

Buyer Origin:

Local: 18%

National: 79%

Foreign: 3%

Denver Multifamily Real Estate Asset Value by Owner Type & Origin (Past 12 Months)

Owner Type:

Private: 48%

User: 13%

REIT / Public: 10%

Institutional: 19%

Private Equity: 10%

Owner Origin:

Local: 32%

National: 65%

Foreign: 3%

Top Denver Multifamily Real Estate Property Statistics

The total amount of multifamily unit deliveries over the past 12 months in Denver is 5,377 with a net absorption of 8,137 units. The average vacancy rate of all multifamily properties in the area is 6.9% with a 12 month rent growth of 4.4%.

12 Month Deliveries (Units): 5,377

12 Month Net Absorption (Units): 8,137

Vacancy Rate: 6.9%

12 Month Rent Growth: 4.4%

Key Indicators for Multifamily Properties in Denver Based on Rating

4 & 5 Star

Units: 122,116

Vacancy Rate: 7.8%

Asking Rent: $1,851

Absorption Units: 607

Delivered Units: 0

Under Construction Units: 12,675

3 Star

Units: 85,666

Vacancy Rate: 6.3%

Asking Rent: $1,373

Absorption Units: 173

Delivered Units: 14

Under Construction Units: 2,184

1 & 2 Star

Units: 50,012

Vacancy Rate: 5.8%

Asking Rent: $1,124

Absorption Units: 27

Delivered Units: 0

Under Construction Units: 132

Denver Multifamily Sales Statistics (Past 12 Months)

Over the last year, Denver’s multifamily real estate market saw 286 properties change hands. The average price per property was $17.6M and the average price / unit was $263K. The average vacancy rate for these properties was 8.8% at the time of sale.

Sales Comparables: 286

Average Price / Unit: $263,000

Average Price of Multifamily Property: $17,600,000

Average Vacancy at Sale: 8.8%

Top Denver Multifamily Property Sales (Past 12 Months)

1) *Rating: 3

Year Built: 1974

Units: 959

Vacancy: 8.2%

Price (Unit): $163,000,000 ($169,968)

Price / SF: $250

2) *Rating: 4

Year Built: 2003

Units: 415

Vacancy: 6.0%

Price (Unit): $160,300,000 ($386,265)

Price / SF: $397

3) *Rating: 4

Year Built: 2004

Units: 500

Vacancy: 8.8%

Price (Units): $154,060,000 ($308,120)

Price / SF: $321

4) *Rating: 4

Year Built: 2016

Units: 465

Vacancy: 6.2%

Price (Unit): $144,750,000 ($311,290)

Price / SF: $301

5) *Rating: 3

Year Built: 1982

Units: 460

Vacancy: 7.0%

Price (Units): $140,000,000 ($304,347)

Price / SF: $358

*Rating is 1-5, 5 being the best

Denver Multifamily Construction Projects Stats

Denver currently has 70 multifamily properties under construction with a total of 15,180 new units coming to the area. These new properties represent 5.9% of the total inventory in the Denver multifamily market, and the average number of units per property is 217.

Properties Currently Under Construction: 70

Total Amount of Multifamily Units: 15,180

Percent of Inventory: 5.9%

Average # of Units: 217

Top Denver Multifamily Projects Under Construction

1) Rating*: 3

Units: 504

Stories: 5

Project Completion: Q1 2023

2) Rating*: 4

Units: 410

Stories: 21

Project Completion: Q2 2022

3) Rating*: 3

Units: 397

Stories: 1

Project Completion: Q2 2022

4) Rating*: 4

Units: 393

Stories: 17

Project Completion: Q3 2021

5) Rating*: 4

Units: 390

Stories: 5

Project Completion: Q4 2021

*Rating is 1-5, 5 being the best

Data Sources: Archwest Capital & CoStar

Denver, CO Multifamily Loan Products

Archwest Capital’s commercial real estate experts provide multifamily market insights in Denver with the statistics above, and also have access to various financing options. Learn more about Archwest Capital’s Colorado Multifamily Loan Products here. Our team is happy to help with any questions you may have regarding potential multifamily investments in Colorado.