What Are the Top Multifamily Markets by Rent Growth in 2021?

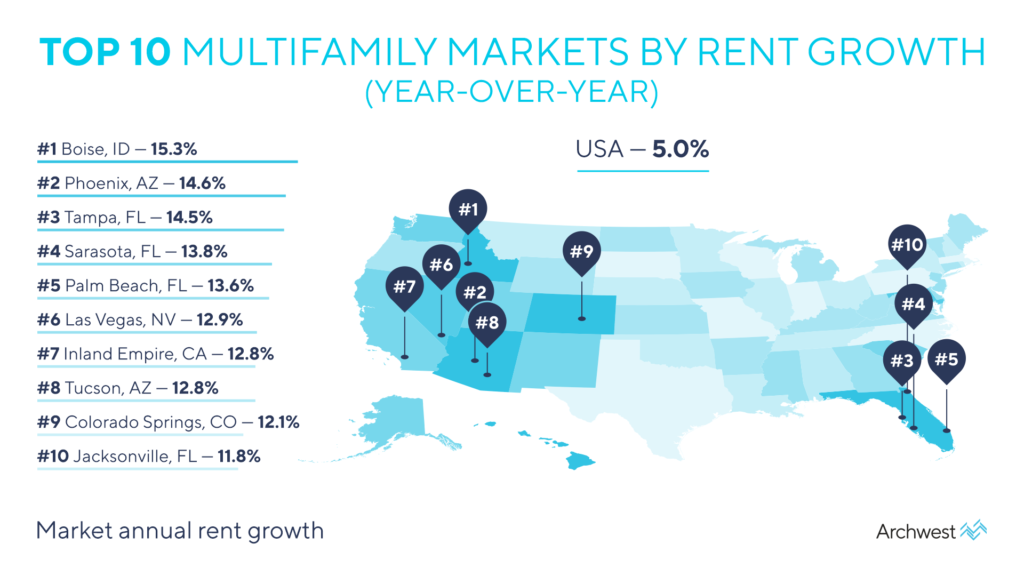

We put together a list of the Top 10 Multifamily Markets by Rent Growth in the United States taking into consideration rent growth year-over-year as the primary driver. We then provided each market’s annual rent growth, vacancy rate, and market asking rent / unit. Along with these data points, we’ve also included each multifamily market’s total population, population growth, the current median household, median household income growth, cap rate, and the total asset value in each location.

Before diving into the Top Multifamily Markets by rent growth, we’ve gathered the aforementioned stats for the National Multifamily Market in order to give some perspective and comparison to the demographic and economic stats below.

National Multifamily Market Statistics

The annual rent growth across the United State was 5% year-over-year while the total population grew 0.2% from 2020 to present. During this time the median household income growth was 7.7% with an average asking rent / unit of $1,445 per month.

Annual Rent Growth (Past 12 Months): 5.0%

Vacancy Rate: 6.0%

Market Asking Rent / Unit: $1,445

Population: 330,057,813

Population Growth (Past 12 Months): 0.2%

Median Household Income: $73,457

Median Household Income Growth (Past 12 Months): 7.7%

Market Cap Rate: 5.4%

Total Multifamily Market Asset Value: $3.9T

Every multifamily market on our list has an annual rent growth that is at least twice as much as the national average. Concurrently the population growth in all of these markets was well above the national average by at least three times.

1) Boise, ID Multifamily Market

Boise, Idaho had an annual rent growth of 15.3% year-over-year, which is three times the national average. During this time vacancy rates stayed at 3.2%, nearly half the national average, and the population growth since 2020 was 2.4%.

Annual Rent Growth (Past 12 Months): 15.3%

Vacancy Rate: 3.2%

Market Asking Rent / Unit: $1,336

Population: 782,561

Population Growth (Past 12 Months): 2.4%

Median Household Income: $73,393

Median Household Income Growth (Past 12 Months): 6.6%

Market Cap Rate: 4.8%

Total Multifamily Market Asset Value: $5.7B

2) Phoenix, AZ Multifamily Market

Phoenix, Arizona had an annual rent growth of 14.6% year-over-year, which is nearly times the national average. During this time vacancy rates were a bit lower than the national average at 5%, and the population growth since 2020 was 1.7%.

Annual Rent Growth (Past 12 Months): 14.6%

Vacancy Rate: 5.0%

Market Asking Rent / Unit: $1,361

Population: 5,116,369

Population Growth (Past 12 Months): 1.7%

Median Household Income: $75,365

Median Household Income Growth (Past 12 Months): 7.7%

Market Cap Rate: 4.5%

Total Multifamily Market Asset Value: $76B

3) Tampa, FL Multifamily Market

Tampa, Florida had an annual rent growth of 14.5% year-over-year, which is also nearly times the national average. During this time vacancy rates were a bit lower than the national average at 5.0%, and the population growth since 2020 was 0.9%.

Annual Rent Growth (Past 12 Months): 14.5%

Vacancy Rate: 5.0%

Market Asking Rent / Unit: $1,439

Population: 3,254,481

Population Growth (Past 12 Months): 0.9%

Median Household Income: $66,282

Median Household Income Growth (Past 12 Months): 10.6%

Market Cap Rate: 5.1%

Total Multifamily Market Asset Value: $36.8B

4) Sarasota, FL Multifamily Market

Sarasota, Florida had an annual rent growth of 13.8% year-over-year, which is also nearly times above the national average. During this time vacancy rates were a bit lower than the national average at 4.7%, and the population growth since 2020 was 1.0%.

Annual Rent Growth (Past 12 Months): 13.8%

Vacancy Rate: 5.6%

Market Asking Rent / Unit: $1,514

Population: 854,841

Population Growth (Past 12 Months): 1.0%

Median Household Income: $74,480

Median Household Income Growth (Past 12 Months): 9.5%

Market Cap Rate: 5.0%

Total Multifamily Market Asset Value: $7.3B

5) Palm Beach, FL Multifamily Market

Palm Beach, Florida had an annual rent growth of 13.6% year-over-year, which is well above the national average. During this time vacancy rates were a bit lower than the national average at 5.8%, and the population growth since 2020 was 0.9%.

Annual Rent Growth (Past 12 Months): 13.6%

Vacancy Rate: 5.8%

Market Asking Rent / Unit: $1,885

Population: 1,525,087

Population Growth (Past 12 Months): 0.9%

Median Household Income: $72,609

Median Household Income Growth (Past 12 Months): 5.5%

Market Cap Rate: 4.7%

Total Multifamily Market Asset Value: $19.8B

6) Las Vegas, NV Multifamily Market

Las Vegas, Nevada had an annual rent growth of 12.9% year-over-year, which is also considerably above the national average. During this time vacancy rates were 1.3$ lower than the national average at 4.7%, and the population growth since 2020 was 1.0%.

Annual Rent Growth (Past 12 Months): 12.9%

Vacancy Rate: 4.7%

Market Asking Rent / Unit: $1,254

Population: 2,324,620

Population Growth (Past 12 Months): 1.0%

Median Household Income: $68,456

Median Household Income Growth (Past 12 Months): 5.1%

Market Cap Rate: 4.9%

Total Multifamily Market Asset Value: $30.2B

7) Inland Empire, CA Multifamily Market

Inland Empire, California had an annual rent growth of 12.8% year-over-year, which is well above the national average. During this time vacancy rates were nearly three times lower than the national average at 2.2%, and the population growth since 2020 was 0.6%.

Annual Rent Growth (Past 12 Months): 12.8%

Vacancy Rate: 2.2%

Market Asking Rent / Unit: $1,719

Population: 4,694,396

Population Growth (Past 12 Months): 0.6%

Median Household Income: $82,937

Median Household Income Growth (Past 12 Months): 11.5%

Market Cap Rate: 4.7%

Total Multifamily Market Asset Value: $39.2B

8) Tucson, AZ Multifamily Market

Tucson, Arizona also had an annual rent growth of 12.8% year-over-year (same as Inland Empire, CA), which is nearly three times the national average. During this time vacancy rates were much lower than the national average at 4.1%, and the population growth since 2020 was 0.7%.

Annual Rent Growth (Past 12 Months): 12.8%

Vacancy Rate: 4.1%

Market Asking Rent / Unit: $943

Population: 1,065,096

Population Growth (Past 12 Months): 0.7%

Median Household Income: $64,014

Median Household Income Growth (Past 12 Months): 9.8%

Market Cap Rate: 5.5%

Total Multifamily Market Asset Value: $9B

9) Colorado Springs, CO Multifamily Market

Colorado Springs, Colorado had an annual rent growth of 12.1% year-over-year, which is also well above the national average. During this time vacancy rates in Colorado Springs were slightly lower than the national average at 5.4%, and the population growth since 2020 was 0.8%.

Annual Rent Growth (Past 12 Months): 12.1%

Vacancy Rate: 5.4%

Market Asking Rent / Unit: $1,301

Population: 757,726

Population Growth (Past 12 Months): 0.8%

Median Household Income: $83,348

Median Household Income Growth (Past 12 Months): 8.9%

Market Cap Rate: 5.0%

Total Multifamily Market Asset Value: $8.4B

10) Jacksonville, FL Multifamily Market

Jacksonville, Florida had an annual rent growth of 11.8% year-over-year, which is also well above the national average. During this time vacancy rates were a bit above the national average at 6.1% (+0.1%), and the population growth since 2020 was 0.9%.

Annual Rent Growth (Past 12 Months): 11.8%

Vacancy Rate: 6.1%

Market Asking Rent / Unit: $1,251

Population: 1,589,789

Population Growth (Past 12 Months): 0.9%

Median Household Income: $77,761

Median Household Income Growth (Past 12 Months): 12.0%

Market Cap Rate: 5.2%

Total Multifamily Market Asset Value: $14.9B

Data Sources: Archwest Capital & CoStar