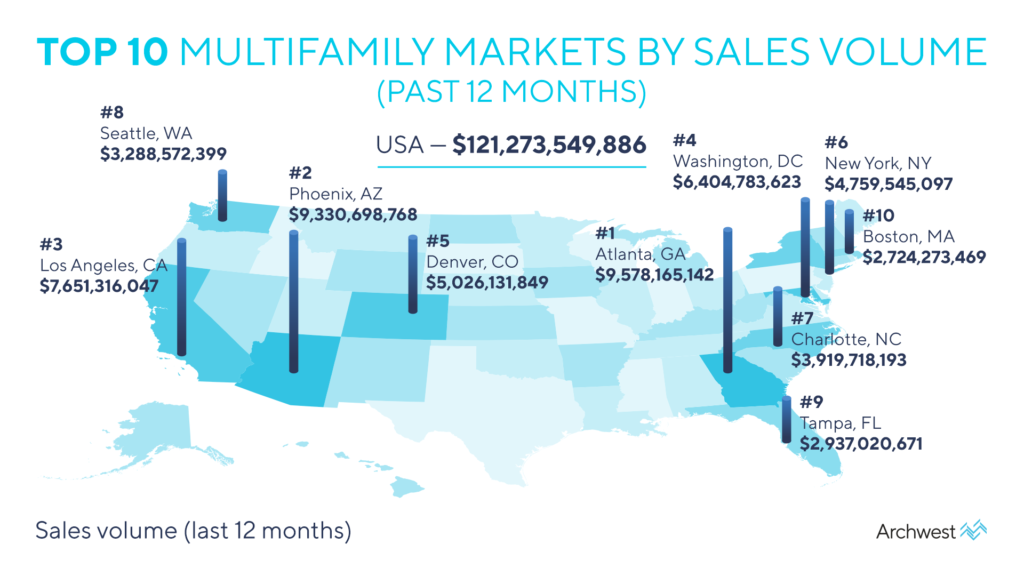

What Are the Top Multifamily Markets by Sales Volume in 2021?

We put together a list of the Top 10 Multifamily Markets by Sales Volume in the United States taking into consideration sales volume year-over-year as the primary driver. We then provided each market’s percentage of inventory exchanged, market sales price / unit, and total inventory of units. Along with these sales statistics, we’ve also included each multifamily market’s total population, population growth, the current median household, median household income growth, cap rate, and the total asset value in each location.

Before diving into the Top Multifamily Markets by rent growth, we’ve gathered the aforementioned stats for the National Multifamily Market in order to give some perspective and comparison to the demographic and economic stats below.

National Multifamily Market Statistics

National multifamily sales topped $120 billion total over the last 12 months at $121.3B. The average sale price / unit was $214K.

Sales Volume (12 Months): $121.3B

Total Multifamily Market Asset Value: $3.9T

% of Inventory Exchanged (12 Months): 3.1%

Market Sale Price / Unit: $214,269

Total Inventory Units: 17,598,185

Population: 330,057,813

Population Growth (Past 12 Months): 0.2%

Median Household Income: $73,457

Median Household Income Growth (Past 12 Months): 7.7%

Market Cap Rate: 5.4%

1) Atlanta, GA Multifamily Market

Atlanta’s multifamily market saw a sales volume of nearly $10B year-over-year at $9.6B total. Each unit in the Atlanta, Georgia area sold for nearly $180K average.

Sales Volume (12 Months): $9.6B

Total Multifamily Market Asset Value: $85.7B

% of Inventory Exchanged (12 Months): 11.2%

Market Sale Price / Unit: $179,527

Total Inventory Units: 461,865

Population: 6,140,114

Population Growth (Past 12 Months): 0.9%

Median Household Income: $77,951

Median Household Income Growth (Past 12 Months): 6.9%

Market Cap Rate: 5.1%

2) Phoenix, AZ Multifamily Market

Phoenix’s multifamily market also saw a sales volume of nearly $10B year-over-year, with sales reaching $9.3B total. The average price / unit sold in Arizona’s capital was $212,593.

Sales Volume (12 Months): $9.3B

Total Multifamily Market Asset Value: $76.1B

% of Inventory Exchanged (12 Months): 12.3%

Market Sale Price / Unit: $212,593

Total Inventory Units: 335,715

Population: 5,116,369

Population Growth (Past 12 Months): 1.7%

Median Household Income: $75,365

Median Household Income Growth (Past 12 Months): 7.7%

Market Cap Rate: 4.5%

3) Los Angeles, CA Multifamily Market

Los Angeles’ multifamily market saw $7.7B of multifamily properties change hands this year. Each unit sold for an average price of $355,767 during this time.

Sales Volume (12 Months): $7.7B

Total Multifamily Market Asset Value: $357.8B

% of Inventory Exchanged (12 Months): 2.1%

Market Sale Price / Unit: $355,767

Total Inventory Units: 976,376

Population: 9,926,872

Population Growth (Past 12 Months): -0.6%

Median Household Income: $82,325

Median Household Income Growth (Past 12 Months): 8.3%

Market Cap Rate: 4.2%

4) Washington DC Multifamily Market

The nation’s capital, Washington DC, saw $6.4B worth of multifamily properties transacted year-over-year. The average sale of each unit sold was nearly $300K at $297,411.

Sales Volume (12 Months): $6.4B

Total Multifamily Market Asset Value: $167.2B

% of Inventory Exchanged (12 Months): 3.8%

Market Sale Price / Unit: $297,411

Total Inventory Units: 525,444

Population: 6,380,904

Population Growth (Past 12 Months): 1.1%

Median Household Income: $112,843

Median Household Income Growth (Past 12 Months): 4.7%

Market Cap Rate: 4.9%

5) Denver, CO Multifamily Market

Denver, Colorado’s multifamily market saw half a billion dollars of properties exchanged this year. The average market sale / unit in the area was $285,432.

Sales Volume (12 Months): $5B

Total Multifamily Market Asset Value: $78.2B

% of Inventory Exchanged (12 Months): 6.4%

Market Sale Price / Unit: $285,432

Total Inventory Units: 258,491

Population: 3,012,187

Population Growth (Past 12 Months): 0.8%

Median Household Income: $93,156

Median Household Income Growth (Past 12 Months): 5%

Market Cap Rate: 4.6%

6) New York, NY Multifamily Market

New York’s multifamily market nearly reached half a billion dollars of sales this year at $4.8B. The average price / unit of these sales was just over $400K.

Sales Volume (12 Months): $4.8B

Total Multifamily Market Asset Value: $599B

% of Inventory Exchanged (12 Months): 0.8%

Market Sale Price / Unit: $404,705

Total Inventory Units: 1,420,472

Population: 14,111,558

Population Growth (Past 12 Months): -0.3%

Median Household Income: $81,971

Median Household Income Growth (Past 12 Months): 3.9%

Market Cap Rate: 4.4%

7) Charlotte, NC Multifamily Market

Charlotte’s multifamily market almost reached $4 billion in sales this year, at $3.9B. The average market sale price / unit in the region was $186,357.

Sales Volume (12 Months): $3.9B

Total Multifamily Market Asset Value: $37.1B

% of Inventory Exchanged (12 Months): 10.6%

Market Sale Price / Unit: $186,357

Total Inventory Units: 185,865

Population: 2,684,171

Population Growth (Past 12 Months): 1.4%

Median Household Income: $73,516

Median Household Income Growth (Past 12 Months): 7%

Market Cap Rate: 4.9%

8) Seattle, WA Multifamily Market

Seattle’s multifamily market saw $3.3B worth of properties exchanged year-over-year. The average sale price per unit in the Pacific Northwest metropolis was over $356K.

Sales Volume (12 Months): $3.3B

Total Multifamily Market Asset Value: $133.5B

% of Inventory Exchanged (12 Months): 2.5%

Market Sale Price / Unit: $356,399

Total Inventory Units: 352,534

Population: 4,052,770

Population Growth (Past 12 Months): 0.9%

Median Household Income: $101,903

Median Household Income Growth (Past 12 Months): 5.5%

Market Cap Rate: 4.2%

9) Tampa, FL Multifamily Market

Tampa, Florida’s multifamily market nearly reached $3B of sales this year, at $2.9B total. The average price / unit for these transactions was $179,498.

Sales Volume (12 Months): $2.9B

Total Multifamily Market Asset Value: $36.9B

% of Inventory Exchanged (12 Months): 8.0%

Market Sale Price / Unit: $179,498

Total Inventory Units: 195,551

Population: 63,254,481

Population Growth (Past 12 Months): 0.9%

Median Household Income: $66,282

Median Household Income Growth (Past 12 Months): 10.6%

Market Cap Rate: 5.1%

10) Boston, MA Multifamily Market

Boston’s multifamily market also saw nearly $3B of properties exchanged year-over-year, at a total of $2.7B. The average price / unit for these property sales was $405,555.

Sales Volume (12 Months): $2.7B

Total Multifamily Market Asset Value: $103.4B

% of Inventory Exchanged (12 Months): 2.6%

Market Sale Price / Unit: $405,555

Total Inventory Units: 239,659

Population: 4,885,674

Population Growth (Past 12 Months): 0.1%

Median Household Income: $104,432

Median Household Income Growth (Past 12 Months): 6.3%

Market Cap Rate: 4.5%

Data Sources: Archwest Capital & CoStar